The smart Trick of Scj Cooper Realtors That Nobody is Discussing

Wiki Article

The Basic Principles Of Scj Cooper Realtors

Table of ContentsAll about Scj Cooper Realtors5 Simple Techniques For Scj Cooper RealtorsScj Cooper Realtors - An OverviewExcitement About Scj Cooper Realtors

For contrast, Wealthfront's ordinary profile gained simply under 8% web of costs over the previous eight years. And the Wealthfront return is far much more tax efficient than the return you would certainly obtain on realty because of the method returns on your Wealthfront portfolio are strained and also our tax-loss harvesting - scj cooper realtors.1% return, you need to have a nose for the neighborhoods that are likely to appreciate most quickly and/or find an awfully mispriced building to get (into which you can invest a tiny amount of money and also upgrade into something that can regulate a much higher rent also much better if you can do the job on your own, however you need to make certain you are being appropriately compensated for that time).

As well as we're speaking about individuals that have big staffs to assist them find the suitable home and make renovations. scj cooper realtors. It's much better to expand your investments You need to believe of spending in an individual building the exact same way you must think of a financial investment in an individual supply: as a large risk.

The suggestion of trying to select the "right" specific residential or commercial property is attractive, especially when you think you can obtain a bargain or get it with a lot of utilize. That method can work well in an up market. 2008 educated all of us about the risks of an undiversified genuine estate profile, and also advised us that utilize can work both ways.

The Basic Principles Of Scj Cooper Realtors

Liquidity matters The last major disagreement versus possessing investment buildings is liquidity. Unlike a realty index fund, you can not market your residential property whenever you desire. It can be tough to forecast the length of time it will take for a house to offer (as well as it typically feels like the more anxious you are to market, the longer it takes).Attempting to earn 3% to 5% even more than you would certainly on your index fund is practically impossible with the exception of a handful of property personal equity investors that draw in the very best and also the brightest to do absolutely nothing however concentrate on outshining the market. Do you actually think you can do it when professionals can't? Our recommendations on rental residential or commercial property investing follows what we suggest on other non-index investments like supply picking and also angel investing: if you're mosting likely to do it, treat it as your "funny money" and also limit it to 10% of your fluid net well worth (as we discuss in Sizing Up Your Home As A see this site Financial investment, you need to not treat your house as an investment, so you do not have to restrict your equity in it to 10% of your liquid internet worth).

However, if you have a residential property that rents for less than your bring price, after that I would strongly prompt you to consider offering the property as well as rather buy a varied portfolio of affordable index funds.

Some people select to purchase a residential or commercial property to rent out on a lasting basis, while others go for short-term rentals for tourists and organization tourists. From houses, single-family homes, and also penthouses to business workplaces as well as retail spaces, the city has a vast variety of residential or commercial properties for budding investors.

The Main Principles Of Scj Cooper Realtors

Is Las Las vega actual estate a great financial investment? Let's check out! Why Las Las Vega is a Wonderful Location to Spend in Realty, A lot of people are relocating to Las Las vega whether it's due to the remarkable climate, no income tax obligations, and a fantastic cost of living. That's why the city is continually becoming a top realty investment destination.

These bring in organization tourists as well as entrepreneurs from all walks of life that, once again, will be looking for somewhere to remain. Having a genuine estate property in the location will be advantageous for them and gain returns for you.

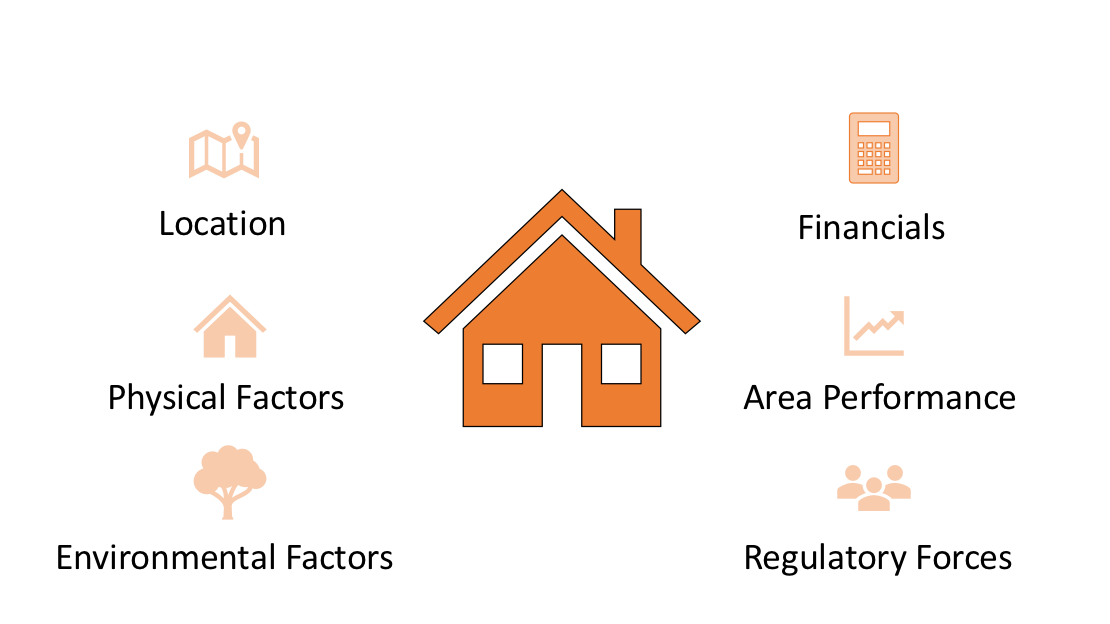

You can expect a stable stream of individuals looking to lease out purchase, also your Las Las vega real estate financial investment. What to Try to find in a Good Financial Recommended Site Investment Residential Property, Investing in real estate is a significant life decision. To establish if such a financial investment is good for you, make certain to consider these vital factors.

An Unbiased View of Scj Cooper Realtors

They can give you a concept of what's in store in the area, so you can better evaluate if this is a good investment. Residential Property Worth, Recognizing the approximated worth of the residential property in development useful content assists you choose whether or not the investment is worth it.

Report this wiki page